Irs Eitc Refund 2025

BlogIrs Eitc Refund 2025. The irs disclosed that all qualifying individuals can expect to receive their eitc refunds into their bank accounts or on their debit cards before 01 march 2025. Learn how to qualify, file, and check your refund status with this comprehensive.

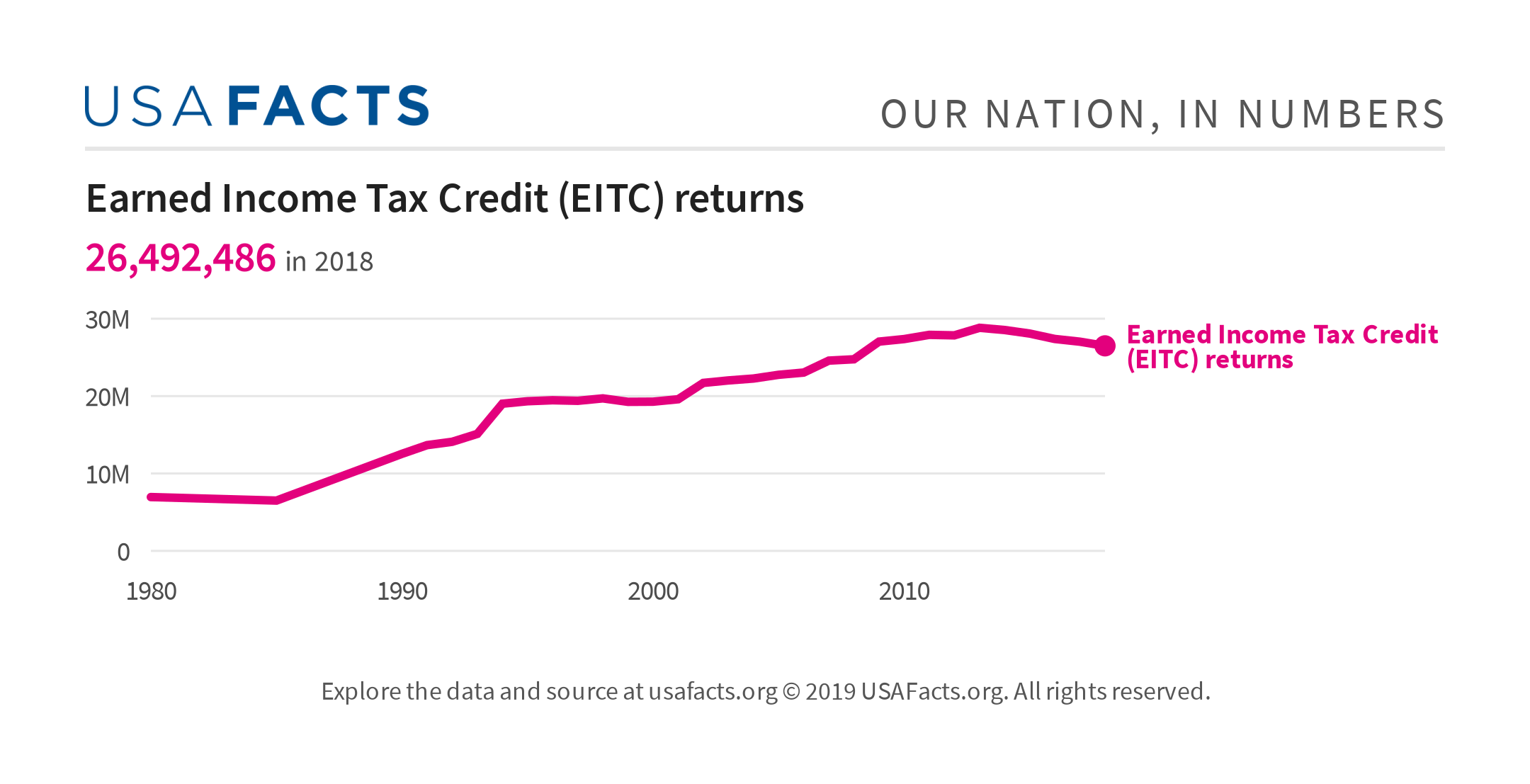

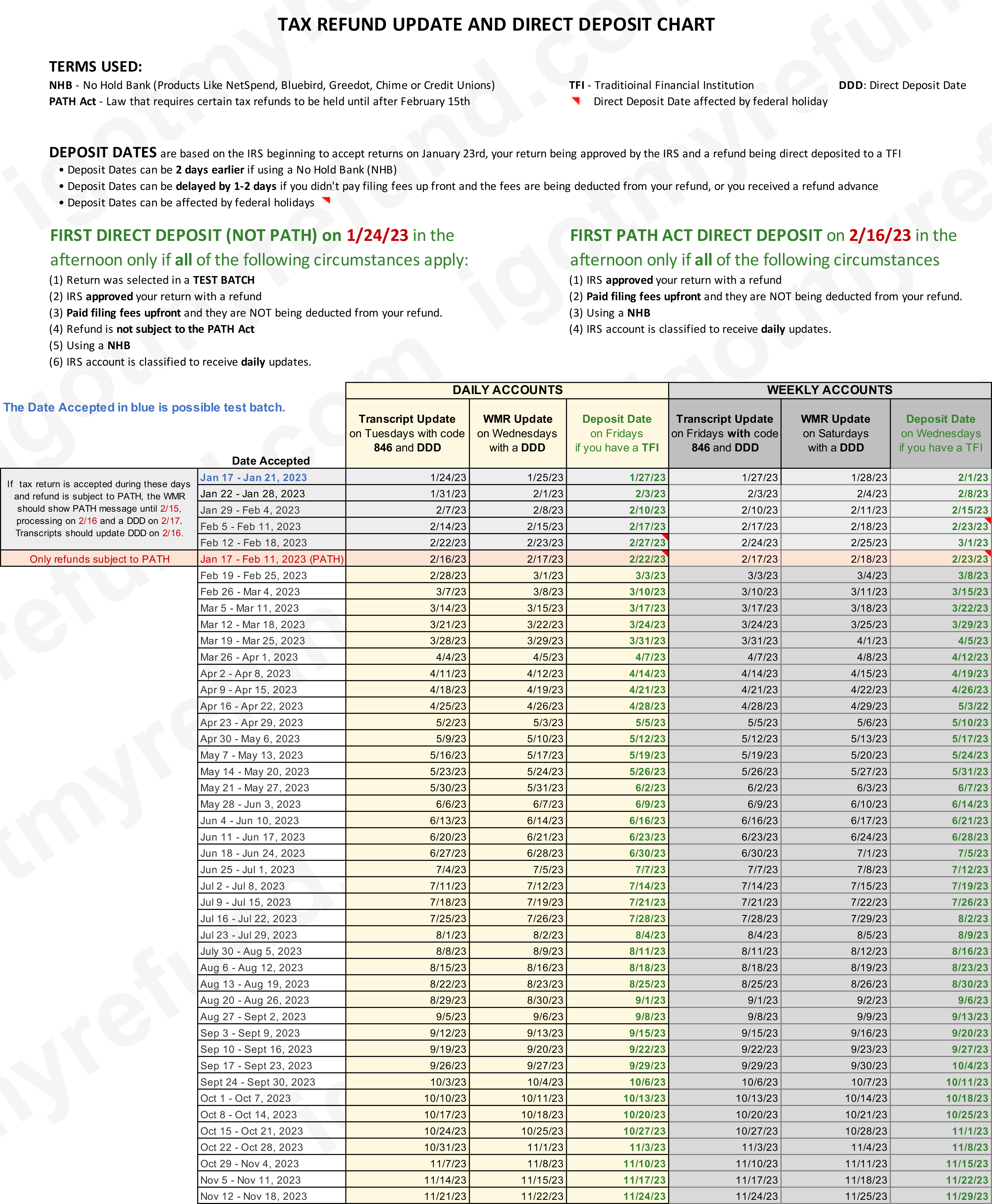

2025 irs tax refund schedule irs eitc refund amount 2025 the exact irs eitc refund amount depends on the applicant’s filing status, number of qualifying children, and their. 27, 2025 workers who earned $66,819 per year or less when they file their 2025 tax return may be able to qualify for the earned income tax credit.

When Will Irs Process Eitc Returns 2025 Karly Pamella, 27, 2025 workers who earned $66,819 per year or less when they file their 2025 tax return may be able to qualify for the earned income tax credit.

What Is The Irs Tax Refund Calendar For 2025 Teddi Lorrie, The irs disclosed that all qualifying individuals can expect to receive their eitc refunds into their bank accounts or on their debit cards before 01 march 2025.

Eitc Refund Schedule 2025 Arlyn Caitrin, The internal revenue service will start releasing the actc/eitc refund for february 27, 2025.

Hastings Direct Refund Email 2025 Rea Leland, Refunds will be received to those taxpayers who have filed their refund electronically.

Irs Eitc Refund 2025 Josey Shirley, 27, 2025 workers who earned $66,819 per year or less when they file their 2025 tax return may be able to qualify for the earned income tax credit.

Irs Refund Schedule 2025 Earned Credit Sayre Ruthann, The irs is expected to begin issuing refunds for the tax year 2025 on january 31, 2025, so taxpayers who also claim the eitc/actc will receive their refunds no later than.

How long do EITC refunds take? Leia aqui What day will IRS release, Here is everything you need to know about the payout dates for the 2025 tax season.

Irs Eitc Refund 2025 Josey Shirley, Refunds will be received to those taxpayers who have filed their refund electronically.

Get a bigger refund with the Earned Tax Credit (EITC), [updated with 2025 path refund release dates] early tax filers who claim the earned income tax credit (eitc) or additional child tax credit (actc) may experience a payment delay or freeze in their refund until late.

Irs Eitc Refund 2025 Josey Shirley, 2025 irs tax refund schedule irs eitc refund amount 2025 the exact irs eitc refund amount depends on the applicant’s filing status, number of qualifying children, and their.